Enserva’s Provincial Spotlight Series provides an overview of the latest policy updates, regulatory changes, and industry-specific developments in our members’ operating areas. In this edition, we revisit Ontario to explore topics pertinent to the energy services, supply, and manufacturing sector.

ICYMI: The previous issue, published on January 22, highlighted Saskatchewan.

Political Election Insights

Ontario was originally scheduled to hold its next provincial election in June 2026. However, a snap election was called, moving the vote up to February 27, 2025. Premier Doug Ford is seeking a renewed mandate for his government, emphasizing the need for a strong majority to effectively represent Ontario’s interests both domestically and internationally.

One of the most pressing concerns heading into the election is the potential economic impact of 25% tariffs on Canadian goods by US President Donald Trump and of retaliatory tariffs imposed by the Canadian government on US goods. These tariffs could have significant consequences for Ontario’s economy, particularly in the auto manufacturing sector, which is a key driver of employment and investment in the province. The Ford government has signaled that it may have to allocate substantial provincial spending to mitigate potential job losses and disruptions caused by these trade policies. Beyond trade, Ontario voters are also weighing the province’s ongoing challenges in housing affordability, healthcare access, and infrastructure development.

Key Party Positions

- Progressive Conservative Party (PC): Led by Premier Doug Ford, the Progressive Conservatives are focused on economic growth, affordability, and energy security. The party supports an “all-of-the-above” energy strategy, including nuclear expansion, energy efficiency programs, and increased hydroelectric capacity. The PCs have introduced new energy efficiency programs and are considering legislation to support their broader energy plan. Additionally, they have prioritized infrastructure investments, healthcare expansion, and job creation, particularly in the auto and manufacturing sectors.

- Ontario Liberal Party: Under the leadership of Bonnie Crombie, the Liberals are emphasizing affordability, healthcare, and environmental protection. They are particularly critical of the Ford government’s handling of the Greenbelt and environmental policies. The Liberals advocate for expanded public healthcare, hiring more doctors, and strengthening transit and infrastructure. Their platform includes incentives for renewable energy, reversing some of the Ford government’s cuts to environmental programs, and bolstering affordable housing initiatives.

- New Democratic Party (NDP): Led by Marit Stiles, the NDP is focusing on housing affordability, healthcare, and workers’ rights. The party has been vocal about the shortage of family doctors and is advocating for increased healthcare funding and expansion of public healthcare services. The NDP also supports rent control measures and stronger environmental regulations, including stricter emissions targets. The party’s energy policies emphasize investment in renewable energy and energy affordability for Ontarians.

- Green Party of Ontario: Under the leadership of Mike Schreiner, the Green Party is prioritizing climate action, sustainable housing, and public transit expansion. Schreiner has called for greater investment in renewable energy, stricter regulations on environmental conservation, and policies to reduce emissions across industries. The Greens also support electrification efforts, increased urban density planning, and incentives for businesses and households to adopt green technologies.

What the Polls Say (At The Moment)

As Ontario quickly approaches the snap provincial election, recent polling data provides insights into the current political landscape. It’s important to interpret these figures with caution, as polls are snapshots of public opinion at specific moments and can change as the campaign progresses.

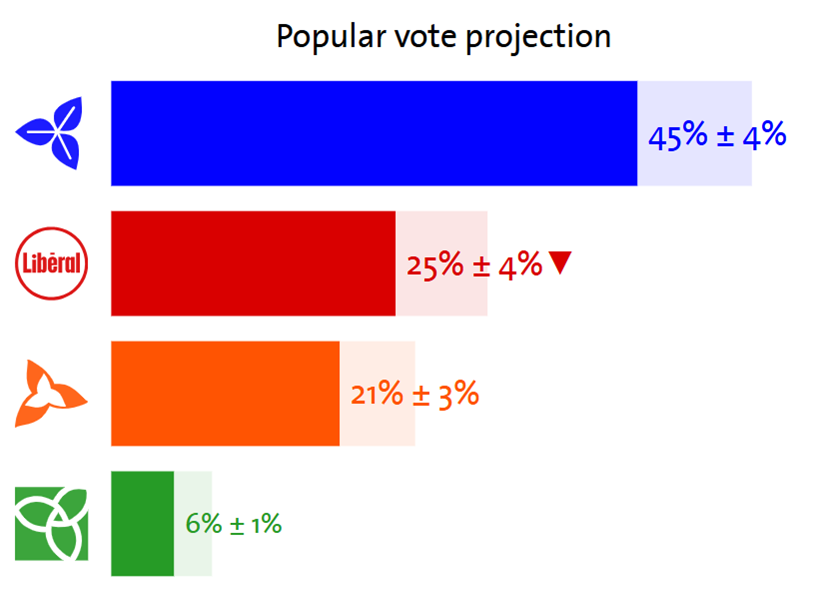

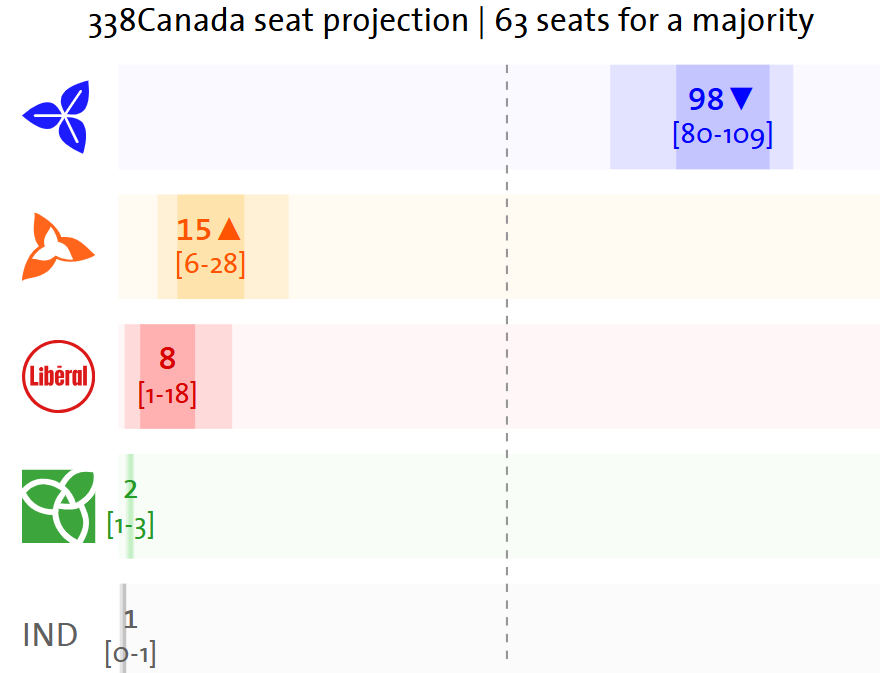

338Canada Projection

(Feb. 2, 2025)

*This projection is calculated using a weighted average of polls by the 338Canada model to estimate current party support. This is not a poll, but the result of an aggregation of polls and modelization of various data. Read more on 338Canada’s methodology here.

* The seat projections are a forecast of the most likely results if a general election were held today. The brackets indicate the current ranges from worst to best possible outcomes. The distributions follow Gaussian-like curves, so the extremes are not as likely as the values near the mean.

Program & Project Updates

- Energy Efficiency Programs: Ontario launched new energy efficiency programs aimed at helping families and businesses reduce their energy use and costs. The programs include rebates for home energy efficiency improvements, an expanded Peak Perks program for small businesses, and a 12-year Electricity Conservation and Demand-Side Management Framework with a budget of up to $10.9 billion. These initiatives target residential, commercial, institutional, industrial, and agricultural segments, including income-qualified households and on-reserve Indigenous communities.

- Wataynikaneyap Power Project: In December 2024, Ontario celebrated the completion of its largest Indigenous-led energy project. The Wataynikaneyap Power Project aims to connect remote First Nations communities to the provincial electricity grid, enhancing energy reliability and supporting economic development in these areas.

Challenges & Risks

- Trade Relations with the US: The imposition of 25% tariffs on Canadian goods by the US and corresponding retaliatory tariffs poses a significant risk to Ontario’s economy. Premier Ford has indicated that such tariffs could lead to substantial job losses and economic downturns, particularly in the auto sector.

- Energy Security and Dependence: Ontario’s reliance on the US for energy supplies presents a significant vulnerability, especially amid current trade tensions. In 2023, approximately 70% of Ontario’s natural gas was imported from the US, primarily from Pennsylvania and Ohio. This gas is essential for heating homes, meeting peak electricity demands, and fueling key industries such as steel and cement. Additionally, Ontario and Quebec together imported about 1.7 billion cubic feet per day of natural gas from the US, accounting for roughly half of their combined consumption in 2024. This dependence highlights the province’s energy security concerns, particularly given the unpredictability of the US administration’s responses to Canada’s retaliatory trade measures. The absence of a west-east pipeline within Canada intensifies this issue, limiting Ontario’s access to domestic energy resources and heightening its exposure to international trade disputes.

The Bottom Line:

Ontario’s energy landscape is evolving as the province seeks to balance economic growth with environmental sustainability. External challenges, such as international trade tensions and energy security concerns, pose risks that will require careful navigation. With Ontario heavily reliant on US energy imports, recent uncertainties highlight the need for long-term stability in supply. While this situation continues to evolve, developments may prompt renewed discussions on broader domestic energy solutions to ensure greater resilience in the face of shifting geopolitical and economic dynamics.